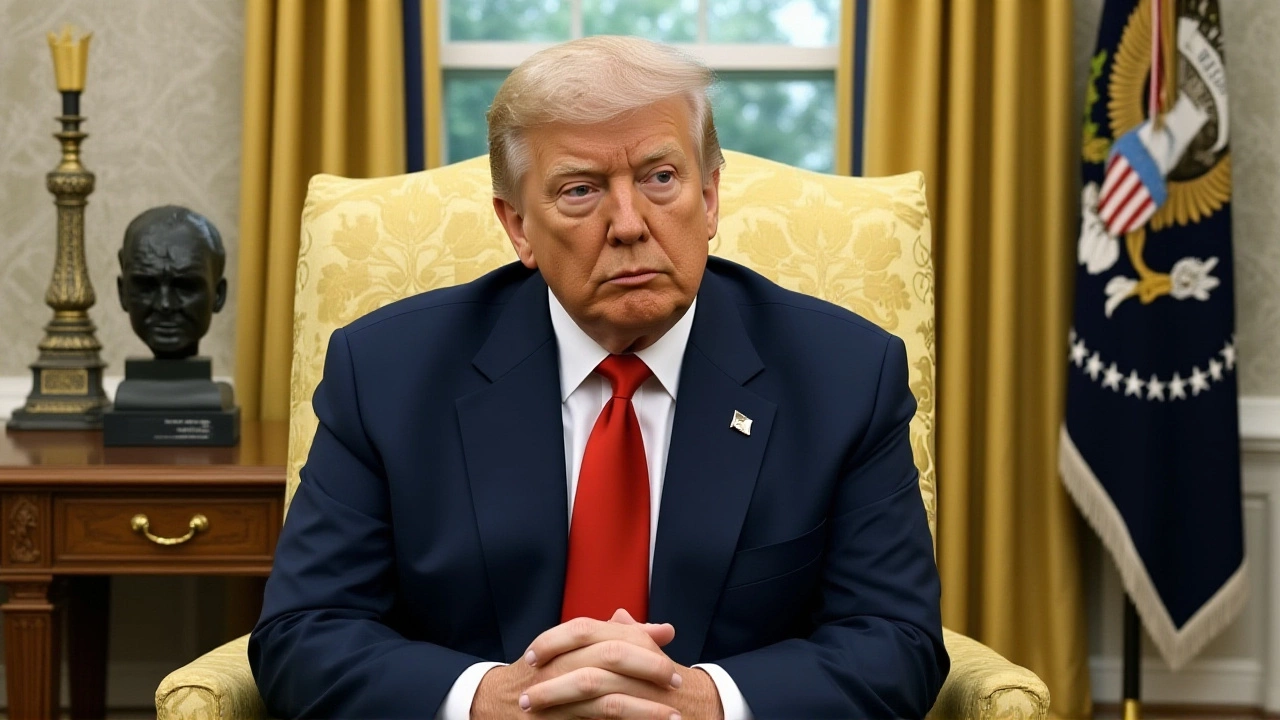

When Donald Trump welcomed Crown Prince Mohammed bin Salman to the White House on November 18, 2025, it wasn’t just another diplomatic handshake. It was the opening act of what may become the largest foreign investment deal in modern U.S. history — one that could pump up to $1 trillion into American infrastructure, tech, and energy sectors. The visit, which began with a private arrival in Washington after a farewell from Saudi officials in Riyadh on November 17, culminated in a series of high-stakes announcements that redefined the economic architecture between the two nations.

A Night of Protocol and Power

The evening of November 18, 2025, turned the White House into a stage for geopolitical theater. In the East Room, where presidents have hosted kings and queens since the 19th century, Donald Trump and First Lady Melania Trump hosted a black-tie dinner for the Saudi delegation. The room — 80 feet long, ceiling soaring 20 feet — echoed with clinking glasses and quiet conversations about AI pipelines and nuclear fuel contracts. No cameras were allowed inside, but insiders say the mood was unusually warm. "It felt more like a family reunion than a state dinner," one attendee later told reporters.The next morning, the two leaders met behind closed doors for over two hours, discussing defense coordination, cybersecurity partnerships, and the long-rumored Saudi-Israeli normalization deal. While no formal agreement was signed, U.S. officials confirmed that Saudi Arabia signaled "serious readiness" to engage in direct talks with Israel — a seismic shift that could reshape Middle East diplomacy.

The $1 Trillion Moment

Then came Wednesday, November 19, 2025 — the day the world took notice. At the Walter E. Washington Convention Center, President Trump stood before a packed hall of CEOs, investors, and diplomats to announce something extraordinary: Saudi sovereign wealth funds and private entities had committed to investing between $700 billion and $1 trillion in the United States over the next decade."This isn’t just about oil," Trump declared, his voice rising. "This is about jobs. This is about factories reopening in Ohio, about wind turbines in Texas, about AI labs in Pittsburgh. My friend, a great gentleman, Crown Prince Mohammed — he’s not just writing checks. He’s building America’s future." The investments span sectors rarely touched by Gulf capital: U.S. semiconductor manufacturing, renewable energy grids, advanced robotics, and even U.S. public infrastructure bonds. Saudi Arabia’s Public Investment Fund (PIF), led by the Crown Prince, confirmed it would allocate $300 billion to U.S.-based tech startups and manufacturing hubs. A consortium of Saudi private investors pledged another $400 billion to real estate and logistics projects, including ports in Savannah and rail corridors in the Midwest.

Why This Matters Beyond the Numbers

The scale of this deal dwarfs previous Gulf investments. In 2018, Saudi Arabia pledged $20 billion to U.S. tech firms during Trump’s first term. This? It’s 50 times that. And it’s not just money — it’s trust. For years, Western investors questioned Saudi Arabia’s commitment to transparency, human rights, and market openness. Now, the kingdom is betting its economic future on American institutions."This is the quiet revolution," said Dr. Elena Ruiz, a geopolitical economist at Georgetown. "Saudi Arabia is moving from being a buyer of U.S. debt to a co-builder of U.S. industry. That changes the entire dynamic. It’s no longer just a security alliance — it’s an economic marriage." The timing is no accident. With U.S. manufacturing rebounding under the new Industrial Resilience Act, and inflation easing, Saudi Arabia is locking in long-term returns before global interest rates climb again. Meanwhile, Trump’s administration is gaining political capital — a major economic win ahead of the 2026 midterms.

The Diplomatic Tightrope

Not everyone cheered. Human rights groups expressed alarm. "You can’t ignore the murder of Jamal Khashoggi and the detention of women’s rights activists while celebrating a trillion-dollar deal," said Sarah Al-Sayed of Human Rights Watch. "This sends a message that money trumps morality." But in Riyadh, the message was different. The Royal Court of Saudi Arabia issued a statement calling the visit "a historic milestone in bilateral relations," emphasizing shared goals in energy innovation and regional stability. The Crown Prince, who has overseen Saudi Arabia’s dramatic economic diversification under Vision 2030, sees this as validation of his reform agenda.And then there’s the Israel angle. While no public announcement was made, U.S. and Saudi officials confirmed that talks on normalization have entered "advanced technical phases." A deal could come as early as mid-2026 — a move that would dramatically alter the balance of power in the Middle East and open Saudi markets to U.S. defense contractors and tech firms.

What Comes Next?

The next milestone? A follow-up forum in Riyadh scheduled for March 2026, where final investment agreements will be signed. U.S. Treasury Secretary Janet Yellen has already formed a joint task force with Saudi officials to oversee fund disbursement and compliance. Meanwhile, Congress is drafting legislation to fast-track foreign investment approvals in critical infrastructure sectors.One thing is clear: this isn’t a one-off. It’s the beginning of a new era — where the desert kingdom and the American heartland are no longer just trading partners, but co-investors in the next generation of global growth.

Frequently Asked Questions

How does this $1 trillion investment affect American workers?

The investments are projected to create between 2.1 and 3.4 million U.S. jobs over ten years, according to White House economic models. Most will be in manufacturing, construction, and tech — with 40% targeted for regions hit hardest by deindustrialization, like the Rust Belt and Appalachia. The PIF’s $300 billion tech allocation includes $50 billion for AI training centers in Detroit and Kansas City, directly partnering with community colleges.

What’s different this time compared to Trump’s first term?

In 2017, Saudi investments were mostly in real estate and private equity. This time, they’re tied to national infrastructure, clean energy, and industrial policy. The 2025 deal includes binding commitments to U.S. labor standards and environmental reviews — something absent in earlier agreements. Also, the scale is unprecedented: $1 trillion dwarfs the $20 billion pledged in 2018.

Could this investment be blocked by Congress?

Legally, no — foreign investments in non-sensitive sectors don’t require congressional approval. However, the Treasury Department’s new task force will review projects for national security risks. If any deal involves critical tech or defense supply chains, CFIUS (Committee on Foreign Investment in the United States) could impose conditions. So far, no red flags have been raised.

What role does nuclear energy play in this deal?

Saudi Arabia is negotiating a civil nuclear cooperation agreement with U.S. firms like Westinghouse and NuScale to build small modular reactors (SMRs). The goal: power future industrial zones and desalination plants. The U.S. will provide technology and training, but not enriched uranium — a key red line to prevent weapons proliferation. The deal includes strict IAEA oversight.

Why did Saudi Arabia choose now to make this move?

With oil demand peaking globally, Saudi Arabia is racing to diversify its wealth. The U.S. offers stable institutions, deep capital markets, and political predictability under Trump’s second term. Meanwhile, China’s economy is slowing, and Europe’s regulatory environment is tightening. This is a strategic pivot — and it’s timed to lock in returns before global markets shift again.

What’s the likelihood of Saudi-Israeli normalization?

Sources in both Washington and Riyadh say a framework is nearly complete. Saudi Arabia wants U.S. security guarantees and access to advanced defense tech in exchange for diplomatic recognition. Israel seeks direct air and trade corridors. If signed by mid-2026, it would be the biggest Middle East peace breakthrough since the 1994 Israel-Jordan treaty — and could unlock billions more in joint tech and energy ventures.

Trump Hosts Saudi Crown Prince as $1 Trillion Investment Pact Announced in Washington

Trump Hosts Saudi Crown Prince as $1 Trillion Investment Pact Announced in Washington

Conan Gray Stuns at Macy’s Thanksgiving Parade with 'Vodka Cranberry' Debut

Conan Gray Stuns at Macy’s Thanksgiving Parade with 'Vodka Cranberry' Debut

Which place is a better vacation and why: Iceland or Ireland?

Which place is a better vacation and why: Iceland or Ireland?

Guatemala's Last-Minute Own Goal Sends Suriname to World Cup Playoffs

Guatemala's Last-Minute Own Goal Sends Suriname to World Cup Playoffs

Vikings lock in Carson Wentz as starter vs. Chargers in Week 8

Vikings lock in Carson Wentz as starter vs. Chargers in Week 8